AWS + AI + Partnerships Deep Dive Report

There has been so much going on at AWS this year at the intersection of Partnerships, GTM, and AI. AWS is scaling and operationalizing AI. With Bedrock AgentCore, vector-native storage, co-funded innovation centers, and a billion-dollar pipeline tied to Anthropic, Amazon is building the infrastructure, tools, and monetization channels for a full-stack AI economy. This isn’t experimentation. It’s a coordinated push to make AWS the default platform for AI agents, semantic data infrastructure, and enterprise-grade copilots, powered by partners, not just services.

In the last quarter, AWS has strategically evolved from “cloud provider” into a partner-first AI ecosystem, with over 140,000 partners across 200+ countries, and more than 15,000 transactable AWS Marketplace listings, including 2,600+ professional services offers. Its launch of Bedrock AgentCore, $100M reinvestment in its Generative AI Innovation Center, and deeply integrated Anthropic business, already delivering $1.28B in 2025 AI revenue, underscore a clear ambition: to build a platform where partners don’t just operate, they co-develop, monetize, and scale AI agents and vertical solutions at enterprise scale.

AWS Partner Strategy: Summary of Core Focus Areas

AI Agents and Tools Marketplace

In Q2 2025, AWS launched a dedicated AI Agents and Tools category inside AWS Marketplace. This new category is aimed at enterprises looking to buy prebuilt AI agents that can be discovered, evaluated, and deployed with ease. AWS partners like Anthropic, IBM, and Brave were among the first to launch tools that comply with AWS’s new Model Context Protocol (MCP), supporting secure agent orchestration and inter-agent communication.

This move creates a governed space where AI agents can be packaged and sold similarly to SaaS apps, something Azure and Google Cloud haven’t yet enabled at this scale. For partners, this provides a structured, monetizable go-to-market. For enterprise buyers, it simplifies access to vetted, agentic solutions they can trust.

Generative AI Innovation Center Reinvestment

In a parallel move, AWS doubled its investment in its Generative AI Innovation Center with a $100M reinvestment and the creation of a formal Partner Innovation Alliance. The goal: fund partner-built solutions that align with AWS’s commercial roadmap in key verticals like healthcare, finance, public sector, and retail.

This is AWS’s response to Microsoft’s Industry Cloud strategy. But instead of building every solution in-house, AWS is putting cash and engineering support behind partner IP, giving partners a fast track from idea to revenue. For customers, this means they can buy production-grade GenAI tools that are AWS-backed, domain-tuned, and implementation-ready.

Amazon Bedrock AgentCore and Agent Marketplace

At the AWS Summit in NYC, AWS launched Bedrock AgentCore, a modular stack for enterprise-grade agents. It includes runtime memory, observability, identity, and safety frameworks. Complementing it is an AI Agent Marketplace, where partners can list and monetize prebuilt agents with plug-and-play GTM.

This builds on AWS’s strength in infrastructure and moves it up the stack. Microsoft’s Copilot model remains dominant at the app layer, but AWS is focusing on modular, reusable building blocks that partners can productize.

Amazon S3 Vectors

AWS rolled out Amazon S3 Vectors as a fully integrated vector embedding layer for RAG and search. By eliminating the need for third-party vector databases, AWS claims over 90% cost savings for common GenAI workloads.

This lowers the barrier for developers and partners to run vector-heavy workloads natively in AWS. Compared to Azure Cognitive Search or Google’s Matching Engine, S3 Vectors offers a lower-friction, lower-cost entry point.

Anthropic and Claude Revenue Momentum

AWS’s early investment in Anthropic is paying off. In 2025 alone, Claude and Bedrock have already generated $1.28B in AWS revenue, with forecasts hitting $5.6B by 2027. Anthropic is deeply embedded across AWS’s model stack, serving as a foundation for agentic interfaces and enterprise solutions.

This positions Claude as the enterprise alternative to OpenAI, offering tighter governance and deeper AWS integration. Partners can safely bet on Claude-compatible tools, while customers gain options beyond Microsoft’s Copilot-OpenAI lock-in.

Nova Customization, Dev Tools, and IDE

AWS also announced Nova model customization and launched the MCP Server, Nova Act SDK, and Kiro IDE, tools purpose-built for agent development and orchestration. These offerings put AWS toe-to-toe with Microsoft’s Copilot Studio and Google’s model garden, but with more focus on infrastructure composability.

Partners now have a complete development environment to build, fine-tune, and deploy agents at scale. For enterprise buyers, this ensures more configurable AI, not just one-size-fits-all copilots.

Expanded Infrastructure, Observability, and Video AI

AWS rolled out several key enhancements in Q2 and July that further support enterprise AI workloads. This includes TwelveLabs for video summarization, BEDROCK free tier credits of up to $200, live S3 Metadata inventory tracking, and EKS scaling up to 100K nodes with 1.6M Trainium support. These enhancements provide partners with new service avenues in observability, video intelligence, and large-scale orchestration. For customers, they translate to lower TCO and faster deployment times compared with Azure or GCP offerings.

Pegasystems and AWS Modernization Alliance

AWS and Pegasystems launched a five-year strategic alliance focused on transforming legacy systems using Bedrock and Transform. Their Pega Blueprint product offers AI-driven automation for migrating legacy apps in financial services, healthcare, and insurance.

This shows AWS's intent to lead in enterprise transformation, not just through compute, but by embedding intelligence into app modernization. Azure has its own migration tools, but few come with embedded GenAI support at this depth.

AWS Partner Summit NYC 2025

At the AWS Partner Summit in NYC in July, AWS clearly signaled that GenAI is a partner-led movement. Sessions emphasized GTM alignment, Bedrock solution scaling, co-sell acceleration, and vertical IP innovation. AWS is now matching Microsoft’s lead in partner enablement with a sharp, execution-focused partner GTM framework.

Public Sector Generative AI Hub

AWS launched a public sector generative AI hub featuring partner-built solutions for government, education, and defense. These include fraud detection agents, compliance copilots, and citizen engagement tools, providing an easy path to secure, FedRAMP-aligned GenAI procurement.

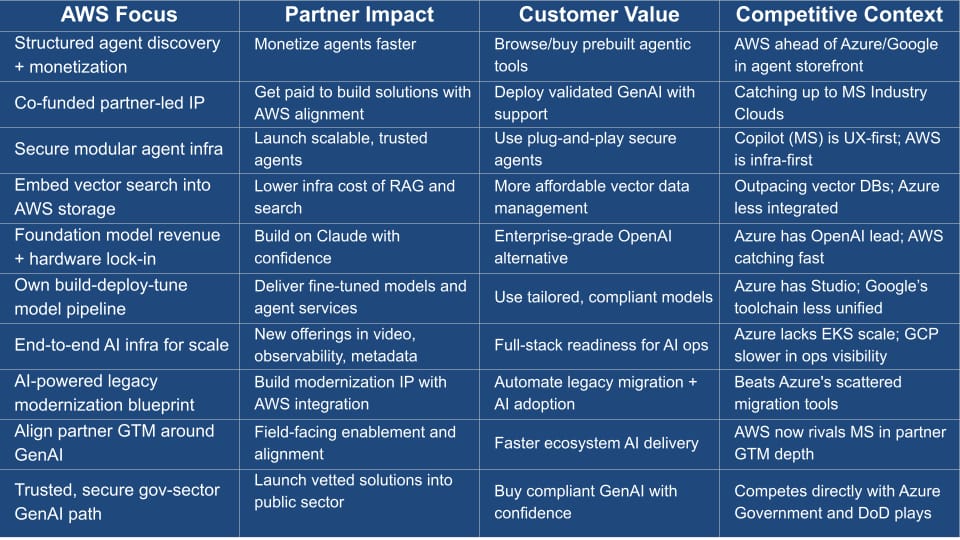

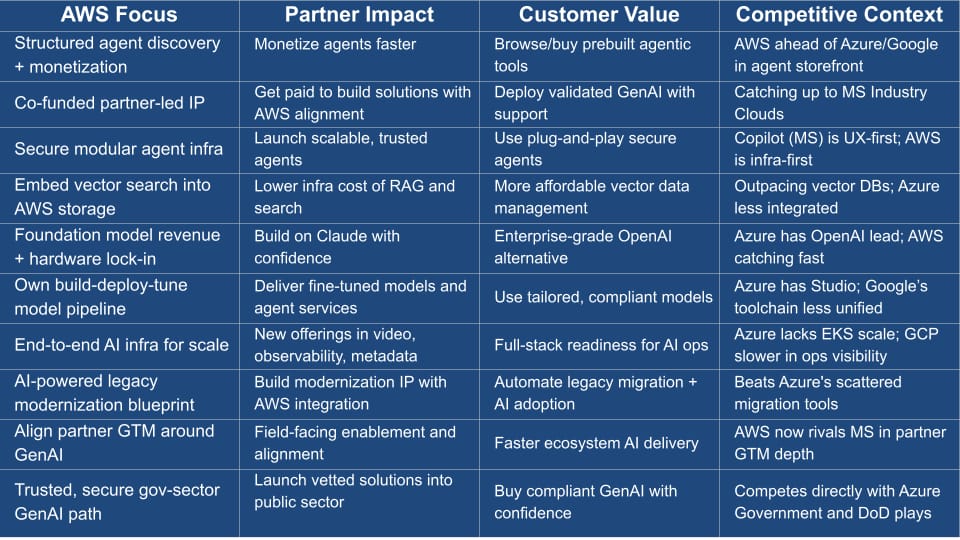

Summary Table

Update | AWS Focus | Partner Impact | Customer Value | Competitive Context |

AI Agents & Tools Marketplace | Agent discovery & monetization layer | Easy monetization path for agent IP | Prebuilt, vetted AI agents | Ahead of Azure & GCP in agent storefront |

GenAI Innovation Center Reinvestment | Co-funded vertical IP with partners | Cash + GTM alignment | Industry-specific GenAI solutions | Counter to Microsoft Industry Clouds |

S3 Vectors | Native vector data at infra layer | Low-cost RAG & vector workloads | Affordable, integrated vector search | Azure/GCP less integrated |

Claude + Anthropic Momentum | Foundation model moat + revenue driver | Build Claude-compatible services | OpenAI alternative with AWS lock-in | Chasing OpenAI lead on Azure |

Nova Customization & Tools | Full-stack model + agent development | Custom AI pipelines | Developer tooling for private copilots | Matching Copilot Studio |

Infra & Observability Upgrades | AI-ready compute and orchestration | Launch at scale with better telemetry | Faster onboarding, better observability | Azure lacks EKS-level scalability |

Pegasystems Modernization Alliance | Legacy system automation via GenAI | Repeatable modernization IP | Faster migration from legacy stacks | Stronger than Azure’s migration tooling |

AWS Partner Summit NYC | Ecosystem co-sell + GTM acceleration | Clarity and alignment on GenAI sales | Confidence in partner-delivered solutions | Now on par with Microsoft in partner GTM |

Public Sector GenAI Hub | Compliance-first GenAI delivery | Launch into regulated sectors | Pre-vetted, trusted AI tools | Direct Azure GovCloud competition |

Strategic Take

AWS is no longer playing catch-up, it’s setting the terms for platform-driven AI scale. From modular agents to Claude-powered infra to monetizable marketplaces, the playbook is clear: bring your own IP, integrate with Bedrock, and go to market with AWS as your copilot.

If you’re a partner, this is your moment to build and monetize differentiated solutions. If you’re a customer, AWS now offers one of the most composable, cost-effective GenAI stacks on the market. If you’re watching the hyperscaler race, Microsoft still leads in app-layer deployment, but AWS is increasingly the platform of choice for those who want to build and own AI, not just use it.